Tax On Used Car In Mississippi . mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. in mississippi, the sales tax rate for used car purchases is 5%. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. In addition to taxes, car purchases in. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. motor vehicle ad valorem taxes. This sales tax is based on the sales price of the vehicle and must be. That’s not too bad compared.

from combos2016.diariodolitoral.com.br

This sales tax is based on the sales price of the vehicle and must be. in mississippi, the sales tax rate for used car purchases is 5%. motor vehicle ad valorem taxes. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. That’s not too bad compared.

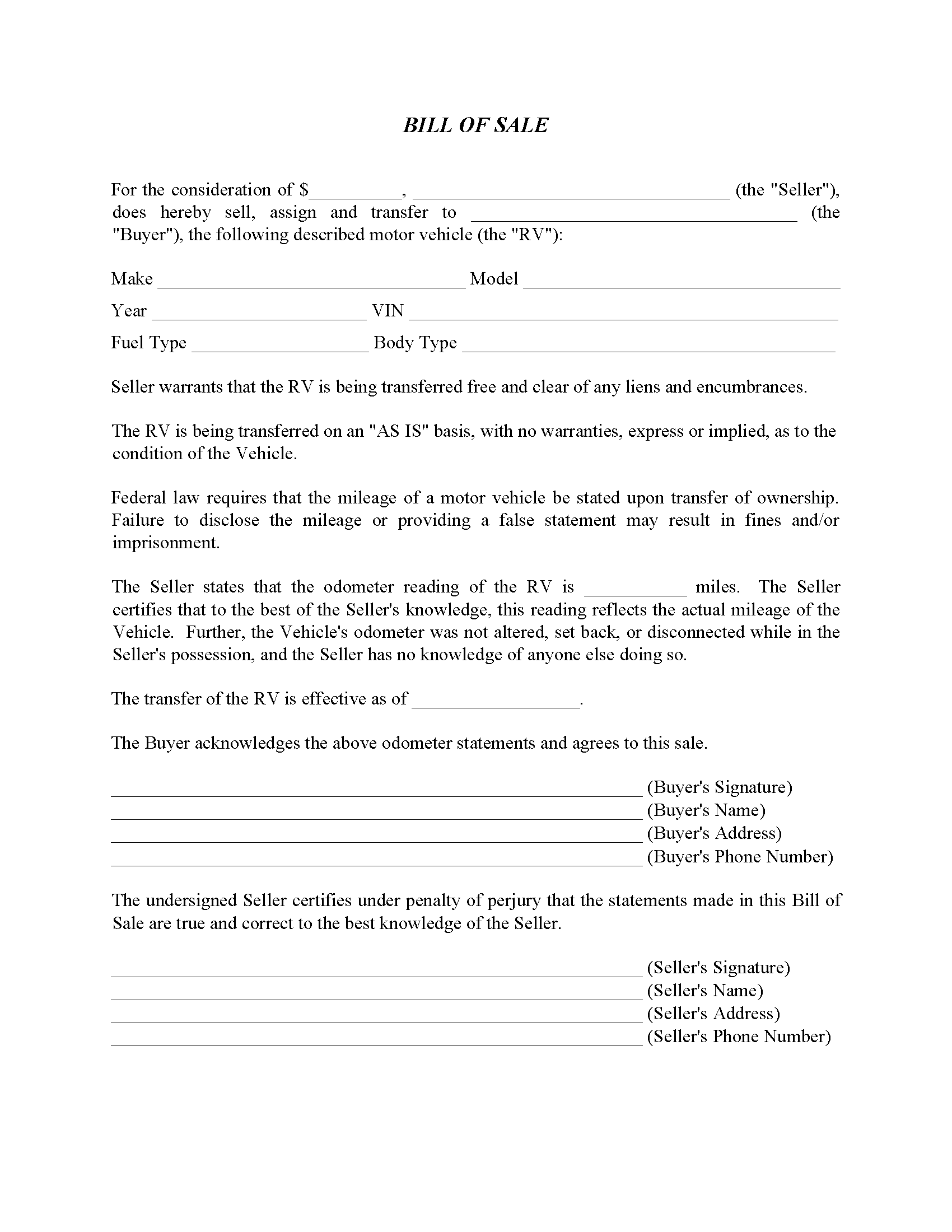

Printable Bill Of Sale Mississippi

Tax On Used Car In Mississippi the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. This sales tax is based on the sales price of the vehicle and must be. That’s not too bad compared. in mississippi, the sales tax rate for used car purchases is 5%. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. motor vehicle ad valorem taxes. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles.

From www.youtube.com

Mississippi State Taxes Explained Your Comprehensive Guide YouTube Tax On Used Car In Mississippi That’s not too bad compared. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. when you buy. Tax On Used Car In Mississippi.

From www.signnow.com

Mississippi Tax S 20122024 Form Fill Out and Sign Printable PDF Tax On Used Car In Mississippi motor vehicle ad valorem taxes. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. In addition to taxes, car purchases in. in mississippi, you pay privilege tax, registration fees, ad valorem. Tax On Used Car In Mississippi.

From www.speedytemplate.com

Free Mississippi Motor Vehicle Bill of Sale PDF 236KB 4 Page(s) Tax On Used Car In Mississippi in mississippi, the sales tax rate for used car purchases is 5%. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in. This sales tax is based on the sales price of the vehicle and must be. Mississippi owners of vehicles with a gross vehicle. Tax On Used Car In Mississippi.

From taxfoundation.org

Mississippi Tax Reform Details & Evaluation Tax Foundation Tax On Used Car In Mississippi That’s not too bad compared. In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. in mississippi, the sales tax rate for used car purchases is 5%. motor vehicle ad valorem taxes. This sales tax is based on. Tax On Used Car In Mississippi.

From www.vaporbeast.com

PACT Act Document Requirements Tax On Used Car In Mississippi In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. That’s not too bad compared. This sales tax is based on the sales price of the vehicle and must be. the statewide rate for used car sales tax in. Tax On Used Car In Mississippi.

From opendocs.com

Free Mississippi General Bill of Sale Form PDF WORD RTF Tax On Used Car In Mississippi in mississippi, the sales tax rate for used car purchases is 5%. This sales tax is based on the sales price of the vehicle and must be. That’s not too bad compared. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. you can use our mississippi sales tax calculator to look up sales. Tax On Used Car In Mississippi.

From www.pdffiller.com

Fillable Online Mississippi Sales And Use Tax Form. Mississippi Sales Tax On Used Car In Mississippi In addition to taxes, car purchases in. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. the statewide rate for used car sales tax. Tax On Used Car In Mississippi.

From esign.com

Free Mississippi Bill of Sale Forms PDF Word Tax On Used Car In Mississippi when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. motor vehicle ad valorem taxes. in mississippi, the sales tax rate for used car purchases is 5%. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax. Tax On Used Car In Mississippi.

From www.templateroller.com

Form 77106 Fill Out, Sign Online and Download Fillable PDF Tax On Used Car In Mississippi mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. in mississippi, the sales tax rate for used car purchases is 5%. when you buy a used vehicle in mississippi from a private owner, mississippi law requires. Tax On Used Car In Mississippi.

From exogszodf.blob.core.windows.net

Cars For Sale In North Mississippi By Owner at Tracy Benedetti blog Tax On Used Car In Mississippi in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private. Tax On Used Car In Mississippi.

From printable.nifty.ai

Free Printable Bill Of Sale Mississippi PRINTABLE TEMPLATES Tax On Used Car In Mississippi Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. This sales tax is based on the sales price of the vehicle and must be. In addition to taxes, car purchases in. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. That’s not too bad. Tax On Used Car In Mississippi.

From exoubmfih.blob.core.windows.net

Renew Mississippi Vehicle Registration at Jennifer Curto blog Tax On Used Car In Mississippi you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. That’s not too bad compared. In addition to taxes, car purchases in. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. the statewide rate for. Tax On Used Car In Mississippi.

From taxfoundation.org

State and Local Sales Tax Rates, Midyear 2021 Tax Foundation Tax On Used Car In Mississippi you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. This sales tax is based on the sales price of the vehicle and must be. the statewide rate for used. Tax On Used Car In Mississippi.

From www.uslegalforms.com

Mississippi Bill of Sale for Automobile or Vehicle including Odometer Tax On Used Car In Mississippi when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. In addition to taxes, car purchases in. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. mississippi collects a 3% to 5% state sales tax rate on the purchase of all. Tax On Used Car In Mississippi.

From combos2016.diariodolitoral.com.br

Printable Bill Of Sale Mississippi Tax On Used Car In Mississippi In addition to taxes, car purchases in. This sales tax is based on the sales price of the vehicle and must be. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. . Tax On Used Car In Mississippi.

From www.withholdingform.com

Mississippi State Tax Commission Withholding Forms Tax On Used Car In Mississippi motor vehicle ad valorem taxes. That’s not too bad compared. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. in mississippi, the sales tax rate for used car purchases is. Tax On Used Car In Mississippi.

From theclunkerjunker.com

Sell your car in Mississippi Cash for cars up to 7,700 The Clunker Tax On Used Car In Mississippi That’s not too bad compared. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. In addition to taxes, car purchases in. when you buy a used vehicle in mississippi from a private owner, mississippi law requires the seller to take off the license. in mississippi, the. Tax On Used Car In Mississippi.

From opendocs.com

Free Mississippi Bill of Sale Forms (5) PDF WORD RTF Tax On Used Car In Mississippi the statewide rate for used car sales tax in mississippi is 5% of the purchase price of the vehicle. Mississippi owners of vehicles with a gross vehicle weight (gvw) of 10,000 lbs or. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. in mississippi, the sales tax rate for used. Tax On Used Car In Mississippi.